This post may contain affiliate links. Click here to read my full disclosure.

The 10-year challenge is circulating on Facebook again. You know the one. You post a picture from ten years ago, in your infancy stages of having a Facebook account and share a recent photo next to it so that you can show your “glow up”.

It’s funny how filters have definitely changed the quality of photos, isn’t it? It used to be ‘what you see is what you get’, but with Snapchat and Instagram filters, you can easily mask over your true self.

You can’t really do that with finances, though. You might be able to hide your financial situation from friends and family, your church, and the rest of the world.

But inside your four walls, you and your spouse know exactly what’s going on. You and your spouse know that your financial goals haven’t exactly come to fruition. But it’s never too late to set goals for your family.

[ss_click_to_tweet tweet=”When I look back at my financial situation 10 years ago, I’m not at all where I want to be. That’s a hard pill to swallow, but it’s the sober truth.” content=”When I look back at my financial situation 10 years ago, I’m not at all where I want to be. That’s a hard pill to swallow, but it’s the sober truth.” style=”4″]

Don’t get me wrong. Our income has grown exponentially over the past ten years. My husband started his financial career as a teller and is now Director of Life and Retirement for an insurance company. I’m so proud of him, especially since he doesn’t even have a degree.

Bear with me. This is a really long post but totally worth the read. I’m going to share how a family whose income is $50,000 a year can pay off all consumer debt, save $20,000 for an emergency fund, and even pay off a $150,000 mortgage!

Ten years ago, I also worked in the banking industry, feeling completely unfulfilled. We were a young, blended family, living paycheck to paycheck, and even though we both knew how to manage our money, we were still making terrible decisions.

Our biggest financial mistake during the last decade has involved vehicles. We were stuck in the constant upside-down car loan cycle.

We even bought THREE brand new cars during the past ten years, thinking they were the answer to getting out of being upside down.

Before you start judging me for such stupid behavior, everyone makes mistakes. Whether it’s failing to save for retirement or racking up major credit card debt or paying $1,000 a month in car payments to keep up with the Joneses, we’ve all done it.

It’s important that we recognize the problem so that we can correct it. We now have a 4-year-old vehicle and a 10-year-old vehicle. Both have lifetime powertrain warranties (that we didn’t pay extra for), and we have finally figured out what our problem is.

Lacking Self-Control

After years of agonizing over our debt, failing to save money, trading in vehicles over and over, etc, we finally realized that our problem isn’t a lack of money or drive but rather a lack of self-control.

[ss_click_to_tweet tweet=”If you lack self-control, any little mishap can totally derail your progress (ie if it isn’t perfect, it isn’t worth it).” content=”If you lack self-control, any little mishap can totally derail your progress (ie if it isn’t perfect, it isn’t worth it).” style=”5″]

This is a major realization for me! You can’t make progress if you’re constantly expecting yourself to be perfect and without fault.

Recognizing your spending habits and patterns is important, but if you lack self-control like me, this is your wake-up call!

Self-Control in Health

A person who lacks self-control in his or her health will eat junk food, even though she knows it’s hurting her body and her goals. She will fail to exercise because she finds other things to fill her time with. She refuses to get pap smears and mammograms because she puts everyone else before her.

I used to think the MLM Beachbody was the answer to my woes. Not so much!

[ss_click_to_tweet tweet=”You can buy all of the programs, hire all of the online personal trainers, and pay for fancy meal plans and food clubs, but if you don’t learn how to practice self-control when an Oreo is staring you in the face, you’ll never reach your fitness goals.” content=”You can buy all of the programs, hire all of the online personal trainers, and pay for fancy meal plans and food clubs, but if you don’t learn how to practice self-control when an Oreo is staring you in the face, you’ll never reach your fitness goals.” style=”4″]

Self-Control in Spending and Debt

This is self-explanatory, but when you’re out of control with your spending, you blow money on things you don’t really need, often finding a way to justify the purchases. I am the queen of justifying stupid purchases. Here’s how it goes:

You trade cars in because you think you really need that third row so that your kids can be separated instead of fighting in the car.

You charge things like groceries or treating yourself to manicures or massages on credit cards and only pay the minimum payments because you have plenty of extra money left after paying all of the bills.

Sound familiar?

This is a destructive habit to get into. Believe me. I’ve done it more times than I’d like to admit.

Self-Control of your Mind and Body

When your mind is out-of-control, you lean on other vices, such as drinking, drugs, or even sex to make yourself feel better.

I’ve been there, done that, too.

[ss_click_to_tweet tweet=”How many times have you woken up feeling hungover or guilty because you did something you should not have done. You self-medicated with any of the above, and while it felt good in the moment, it made you feel worse afterward. ” content=”How many times have you woken up feeling hungover or guilty because you did something you should not have done. You self-medicated with any of the above, and while it felt good at the moment, it made you feel worse afterward. ” style=”6″]

Losing self-control is not a good feeling, and I’m harping on it because I realized this year that self-control is the key to finally taking control of my finances and my life.

And it can be the same for you, too, friend.

How to Make a Financial Plan with Family Goals in Mind

You don’t have to visit a financial advisor to make a financial plan and set goals for your family’s future. You simply need a clear mind, an open heart, and the desire to make the changes needed to flip the script on your financial future. The last 10 years don’t matter going forward. Got it?

1. What are your Dreams and Family Goals?

What do you want to be when you grow up? Seriously! Are you doing what you always dreamed of? Would switching jobs increase your income and happiness?

I have a friend who has been a nurse her entire career, and she went back to school in her 50’s to become a nurse practitioner. Not only did this increase her income, but she is now working in a practice with better hours and quality of life.

It’s never too late to take a chance on you. Just be sure to financially prepare if you’re at a later stage of life going back to school. There are dentists and school counselors with upwards of $200,000 in student loan debt, and the stress is simply not worth it.

2. What Season of Life Will You Be in 10 Years from Now?

I have a child graduating high school in just 3 years. My youngest will graduate in 10 years, and we will be empty nesters. What do we want to do in 10 years with our newfound “freedom”? The answer for us is to travel. I want to be able to pay for family vacations with my kids and grandkids (eventually).

Where will you and your family be in 10 years? Knowing this is important before you set goals.

3. What is your WHY?

WHY do you want to be financially secure in 10 years? What motivates you and drives you to pay off the debt, save for retirement, or even to pay off the house early?

For me, it’s knowing that we can cash flow my kids’ college. It’s being able to travel to new places we’ve never been and falling in love with my husband all over again.

It’s about being able to give to our church and our community…to organizations I’m passionate about…and not having to ever worry about money again.

4. How are you Going to Reach your Goals?

Now it’s time to put pencil to paper, writing down your goals, and taking action to start crushing them. One year I created a vision board, and on the board I added photos of a renovation because I desperately wanted to upgrade our ugly, ranch home.

I cut and paste ‘$50,000’ out of a magazine onto the board because that was my salary goal as a first-year real estate agent in a new city.

And guess what? I reached both of those goals! Having my goals front-and-center every single day helped me to realize them. But you need a plan if you’re going to reach your 10-year financial goals.

10-Year Challenge Plan Template

Now that you know what motivates you to reach your financial goals over the next 10 years, it’s time to put together a plan to reach them.

Create a Budget

You have to know where your money is currently going so that you can reach your financial goals. You cannot just spend frivolously and blindly, but you don’t have to practice extreme frugal living either.

Start by creating a personal budget, documenting all income and expenses. You’ll need a cash envelope wallet system (nothing too fancy) to track your everyday cash expenses, such as gasoline, groceries, and fun money. This is crucial because there’s less of an emotional response when swiping plastic (credit or debit).

When you’re handing over hard-earned cash, you think twice as your money dwindles down. I learned this when I was donating blood plasma for extra money.

I spent about two hours a week during the plasma donation process, and knowing that I went through physical pain to pay off our debt faster kept me from blowing that money on items that had nothing to do with our goals.

It may seem like one of the most extreme ways to make money, but we earned up to $5,000 side hustle money (untaxed) each year donating plasma near me.

10-Year Financial Goals – Samples

Everyone’s financial situation is different. Likewise, you and I probably don’t have the exact same goals. My current goal is to become 100% consumer debt-free.

This means I want to pay off everything except our mortgage. Sounds easy, right? Every single time I’ve tried to pay off the debt, I’ve taken care of all of the smaller debts, and those bigger credit cards hold me back.

I haven’t been disciplined enough to actually follow through when faced with a $7,000 balance. I know it feels impossible, but we can do it!

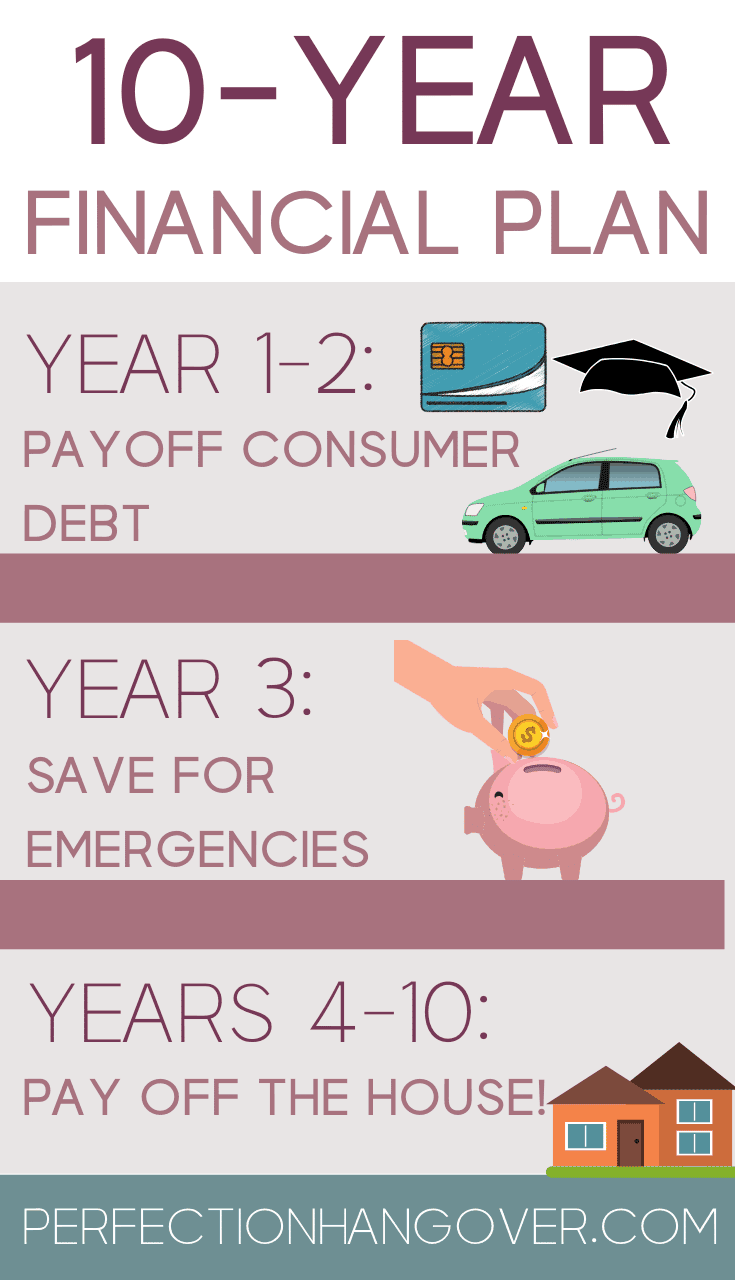

2-Year Challenge to Pay Off Debt

I’ve compared the differences between the debt snowball and the debt avalanche in detail before, but it is important to know that neither one is better than the other when it comes to paying off debt.

The end result is what matters. Getting to the finish line should be your #1 goal…no matter the cost.

The first two years in your 10-year Challenge should consist of finally taking care of the consumer debt. Yes, I’m talking about cars, too.

But instead of pre-planning your debt snowball months in advance, work one month (or even one paycheck) at a time.

Murphy always pays a visit in the middle of your debt payoff plan, so be prepared for it and pause the debt snowball or avalanche in order to take care of small emergencies.

Creating a Debt Payoff Plan

Let’s assume you earn $50,000 per year take-home pay (after taxes). This comes out to $4,166.67 per month. Take a look at your health insurance premiums. If you’re paying more than $135 per month for a family of five, look into Christian Healthcare Ministries or another medical cost-sharing ministry.

Right now, as we speak, it’s open enrollment at my husband’s employer. Health insurance for our family of five would cost $900 per month, and we pay $175 per month for CHM.

We were even tested last year when my son broke his wrist playing football, and we had medical claims. Two surgeries later and $60,000 in medical bills, our out-of-pocket responsibility was only $1,300! See how it works here (opens in a new window).

Your mortgage or rent should not be higher than 30% of your take-home, so let’s assume your mortgage is around $1,100 per month.

You owe $25,000 on a used car and have a total of $8000 in credit card debt and $30,000 in student loans. You feel like you’re drowning, but I’m going to tell you exactly how to handle this situation.

You need to cut your expenses down to the bare minimum for the next couple of years. That means cut cable or satellite and switch to YouTube TV or another streaming service. Just fall for the trap of multiple subscriptions! They will nickel and dime you if you’re not careful.

You can switch cell phone providers to Cricket or Republic Wireless to save money until you get your debt paid off.

If you use your cell phone for business or sales leads, I would not recommend switching from a really reliable service provider. Some of these MVNO’s are not as reliable as AT&T and Verizon.

So back to the budget. Let’s assume that your household expenses (utilities, fuel, groceries, etc) average $1,500 per month.

Out of our $5,000 income, we’ve spent $1,100 on the mortgage, $1,500 on household expenses, and let’s assume the car payment is $400 per month and the credit card debt minimum payments are $100 per month and student loan payment is $300 per month.

This leaves you with $1,600 to put towards your debt payoff plan!

Now, without thinking twice, you start paying $1,600 additional every month towards typically higher interest rate credit cards, then auto loans, and finally student loans.

Since you’ve increased your credit card payment from $100 to $1,700 per month, you’re able to pay the $8,000 balance off in just under 5 months.

Then, you’ll increase your $400 car payment to $2,100 per month. It will take you 11 months to pay off the car. And you guessed it! Student loans are next!

Your student loans will be a major battle to tackle. Some would say to take your time paying them off because they typically have a low-interest rate.

But when you can pay $2,400 per month towards your student loans (instead of measly $300 payments), your balance will dwindle down rather quickly.

You should owe around $26,000 after 16 months of paying off your other consumer debts. $26,000 divided by $2,400 payments equals 11 months to pay off.

This example isn’t accounting for interest, so there will be a little bit more but not much. You’ll be saving THOUSANDS of dollars in interest, and even though you didn’t get it paid off in 24 months, it still only took you 27 months!

Year 3: Increase Retirement Contributions

Now that you have $2,400 burning a hole in your pocket every month, it’s time to increase your retirement contributions.

According to Dave Ramsey, you should stop all retirement contributions while you’re paying off debt. I don’t fully agree with that. I do think you should (if you can afford it) at least take advantage of 401k company match. So up until this point, you should have been contributing 5% *again IF you could afford it. If your hole is too deep, by all means, pause.

Now that you’ve paid off your debt, though, let’s go crazy and take advantage of your employer match. Assuming your company matches 100% of your contributions up to 5%, let’s put in 10%. That means 15% of your gross income is going into retirement (10% pre-tax, 5% from your employer). Not a bad deal!

By increasing your retirement contributions, you’ll actually save quite a bit on income taxes. You can see how much you would save using this salary paycheck calculator. It even factors in state taxes for every state in the US!

Year 3: Fully Fund your Emergency Fund

Make sure you have up to 6 months of expenses (not income) saved for emergencies. That $2,400 per month leftover is now a little less since you’re contributing 10% pre-tax to retirement, so let’s assume you have $2,000 per month left.

If your monthly expenses average $3,500 per month, multiply that by six to come up with your Emergency Fund amount. You’ll need $21,000 in savings for a rainy day, and it should take you about 10 months to save it up.

Years 4-10: Pay Down the Mortgage Aggressively

At this point, I’m assuming you already own a home and probably purchased it with a 30-year fixed rate. As a Realtor, I know that this is the most common type of loan financing, especially for first-time buyers.

If your mortgage including escrow is around $1,100 per month as we mentioned earlier, you probably financed around $150,000.

In the first few years of owning a home, the payments are primarily paying for interest. It’s not until you reach about halfway through the 30-year term that you actually start making significant strides towards principal repayment.

That being said, there are a few ways you can pay off your mortgage faster.

The first thing you can do is start making biweekly mortgage payments instead of monthly. Bankrate has an awesome biweekly mortgage calculator on their website that shows how you can save up to $20,000 in interest on a $150,000 mortgage just by paying half-payments every two weeks instead of once a month!

Now, remember that every two weeks is not the same thing as semi-monthly. So if you’re paid twice a month, you’ll need to budget for one extra mortgage payment per year, which is basically what the biweekly mortgage payment does for you.

If you don’t want to bother with paying it every other week, simply pay an extra mortgage payment (towards principal) once a year.

This doesn’t mean you’ll pay off the mortgage faster, though.

Now that you’ve paid off all of your consumer debt, and you have a fully-funded emergency fund in place along with a great start for retirement savings, it’s time to start throwing additional funds towards the principal of your mortgage.

On a $1,100 house payment, approximately $760 is principal and interest. The rest is reserved for escrow (homeowners insurance and taxes).

Since only $200 is going towards principal (and $500 to interest OUCH!) every month, you’ll want to make $2,000 principal payments in addition to your existing payment.

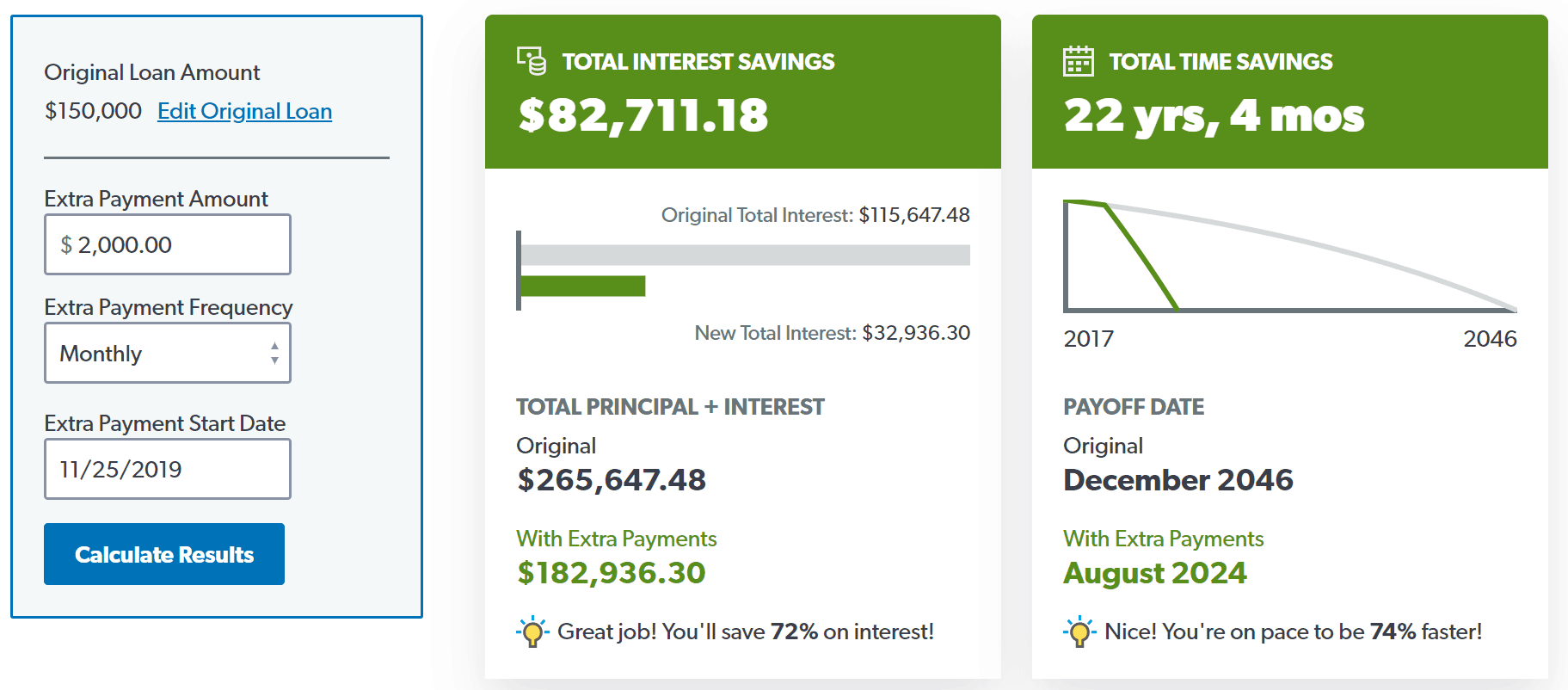

Take a look at Dave Ramsey’s Early Mortgage Payoff Calculator in action!

When you pay an extra $2,000 to your mortgage (in the above scenario), you’ll save more than $80,000 in interest, and you’ll pay off your home 22 years and 4 months early!

Once your mortgage is paid off, you are able to experience complete freedom.

I don’t know about y’all, but that seems pretty life-changing to me! 10 years to complete and total debt freedom, and we didn’t even assume job promotions, bonuses, raises, or even tax refunds!

I know this is overwhelming, and your mind is probably blown right now. Mine was, too, when I really started thinking about just how possible this is.

But you’ve got to take it one day and one step at a time. Print this out, share it with a friend. Paste it to your refrigerator. Don’t let the next 10 years pass you by without achieving your financial goals.

Time Flies By

Now, I want you to close your eyes and remember the past ten years. Where were you ten years ago today? You’ve already seen the 10-year challenge on Facebook. Now imagine how your finances were then. Are you exactly where you want to be financially?

Or could you have done better? There’s no sense in harping on the past. Instead, I want you to now realize that the last 10 years have flown by. You may have graduated college, started a career, gotten married, gotten divorced, become a single mom, found a second chance at love, etc.

But have you achieved your financial plans and family goals? If not, it’s never too late. If you’d like help with your own financial goals, you can find help here.

Don’t Forget to Pin This to Your Financial Goals Board on Pinterest!

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.

Is this just for women?

Of course not! Men work, too 🙂