What does a personal finance coach do?. I received a message today which read, “What are you doing? I’m confused??”. My job title may be confusing to some, so I thought I’d address the question. Hopefully, this gives you some insight as to what exactly personal finance coach tasks include.

So What Does a Personal Finance Coach Do Exactly?

As an online personal financial coach, I offer financial tips such as help with budgeting, ways to save money, how to make the most of your banking products, and so much more. You know that saying “Fitness is 80% food, 20% exercise”? A major “A-ha” moment for me was when I realized that personal finance success comes from being completely self-aware of your strengths AND your weaknesses. As a free-spirited nerd, my nerdy numbers side has a constant tug-o-war with my wanderlust, free-spirited personality. The struggle for me is so real that I have to constantly remind myself what my goals are so that I can continue to WIN financially. I help ladies uncover their “why” and let go of limiting beliefs and any scarcity (or lack) mindset. Personal finance is 80% behavior and 20% money.

Help with Budgeting

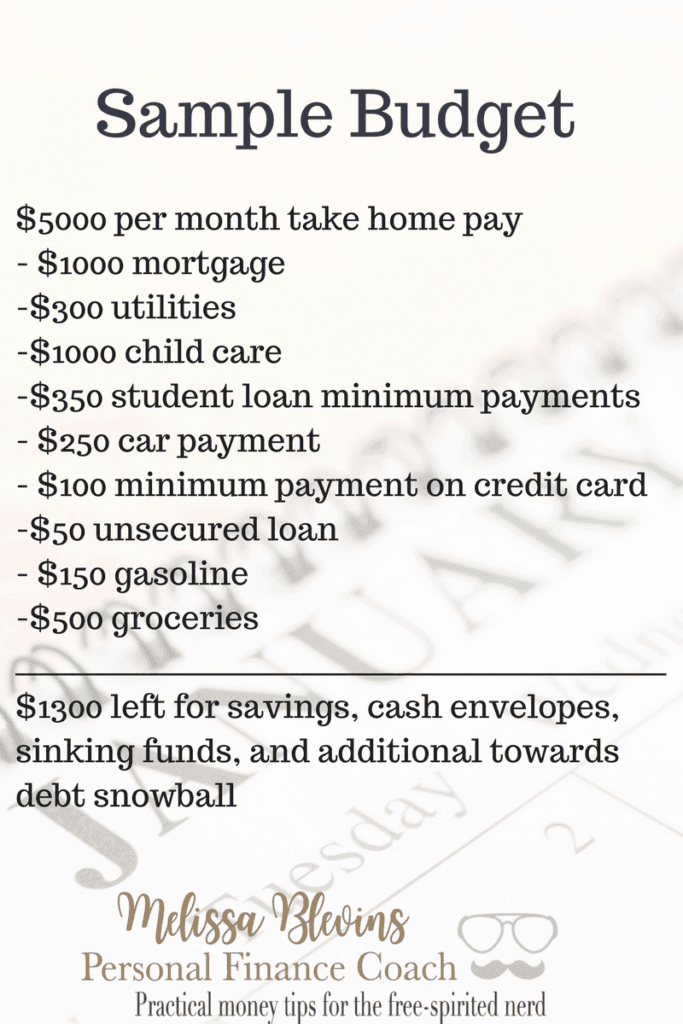

Budgeting is a very important part of keeping track of your finances. You need to tell your money what to do every single month. You do this by having a written budget. Start by writing down your net, or take-home, pay each time you get paid. You’ll write a separate budget for each time you have money in your hands. Next, start listing your expenses, bills, and debts, line by line, and you, hopefully, will have some money left at the end of the month. If not, you are living paycheck to paycheck, and this post can help with that. We need to get you caught up on bills FAST!

Help Saving for College

One day, you’ll look up at your teenager and think, “When did they grow up so fast?” And then you’ll probably have a freak-out moment if you haven’t started saving for his or her college. I wrote about saving for your kids’ college in your 30’s and 40’s here. There are two main products I prefer to use for college savings, the 529 plan & the Roth IRA.

Help Paying off Debt

I was raised on loaves and fishes food pantry visits and charity from different organizations such as the Rotary Club and Knights of Columbus. My sister struggles with a rare kidney disease which landed her in hospitals all.the.time as a child. We are very thankful for Ronald McDonald House of Galveston, Texas. If it weren’t for some of these organizations, we wouldn’t have been able to eat. We wouldn’t have been able to have Christmas gifts. I wouldn’t have been able to obtain eyeglasses my Senior year of high school. My sister and parents would have struggled when they traveled to Galveston for kidney biopsies once a year. I am forever grateful to these charitable organizations, but I feel like I labeled myself a bit of a charity case growing up.

I’ve had to retrain my mindset to focus on my goals of paying off debt, saving for my kids’ college, saving for retirement, and paying cash for cars and vacations. I never want to be in the place of charity again. And I never want our children to know that struggle. So if you’re in debt, and you’re looking for a way out, I can help you pay off your debt, one creditor at a time. I don’t follow a one-size-fits-all debt payoff plan. I give you a detailed plan, based on your particular needs and goals. If you need help, fill out my budget analysis form, and we’ll schedule a time to create your detailed plan. I can promise the investment is well worth it, and I will probably be able to save you the cost in the first month of starting a budget!

If you know how to budget but just want to see where you stand, grab my free debt snowball calculator spreadsheet. You’ll list your own debts, smallest to largest, along with interest rates, and the calculator does all the work for you!

What a Personal Finance Coach Does Not Do

I’m not a self-proclaimed expert on money. Let me repeat that. I am not an expert on money. I have simply lived enough life and been in the financial services industry long enough to have learned a lot of financial lessons, from learning to budget as an elementary student to nearly being evicted from my home to FINALLY seeing the light at the end of the tunnel. I should probably write a book about it all at some point! 😛 It’s been a long, hard road, but I wouldn’t change it for anything! I now get to help others through their journey to financial freedom! I get to provide support and encouragement as you navigate paying off debt, saving for retirement, paying cash for college, buying your first home, and finally realizing YOUR worth! I am not a Certified Financial Planner or a Financial Advisor. I do not offer investment strategy advice, nor do I offer advice on taxes. If you need advice in any of those areas, I’d be happy to refer you to a Certified Public Accountant or Financial Advisor.

Personal Finance Coach Tasks

I’ve simply always had a passion for financial literacy, and with the internet and YouTube, I have a platform beyond my wildest dreams! So I’m not holding back from sharing my experiences and advice/opinions. So to answer the question what does a personal finance coach do, you have to know that I’m here for YOU! I’m guiding and encouraging you on your journey to financial freedom. We will set out a clear plan with “homework”, and it’s up to you to change your habits.

By understanding what does a personal finance coach do, you will move forward toward financial freedom IF you’re willing to listen to the suggestions and modify your behavior. Your effort will determine your success. So let’s get started!

If you want to learn more, drop me an email. I’m so glad you’re here, and I can’t wait to get to know you! Don’t forget to visit my YouTube Channel and Subscribe so you can watch videos on the go: Money + Blogging + Business Simplified.