This post may contain affiliate links. Click here to read my full disclosure.

You made it! 2017 was a rough year for so many, and I, personally, am glad it’s over. It’s time to shift gears and crush it! I want you to consider the New Year, Same You concept. When the clock struck midnight, you were still the same person. You’ve got work to do! You’ve probably heard of Albert Einstein’s definition of insanity: doing the same things over and over but expecting different results. The truth is nothing changes if nothing changes. I want this year to be one of the best years of your life! I want 2018 to be the year you attack your financial goals with a vengeance! Here’s how we’re gonna do it.

Step 1: Assess your Current Situation

If you haven’t sat down with your spouse (if applicable) and looked at your financial situation, it’s about to get really, really uncomfortable. Grab your paycheck stubs, your stack of bills and a cup of coffee (or vodka…pick your poison) and get to work. This part is NOT fun at first. You have to see where your money is going so you can set clear goals and begin telling your money what you want it to do for you.

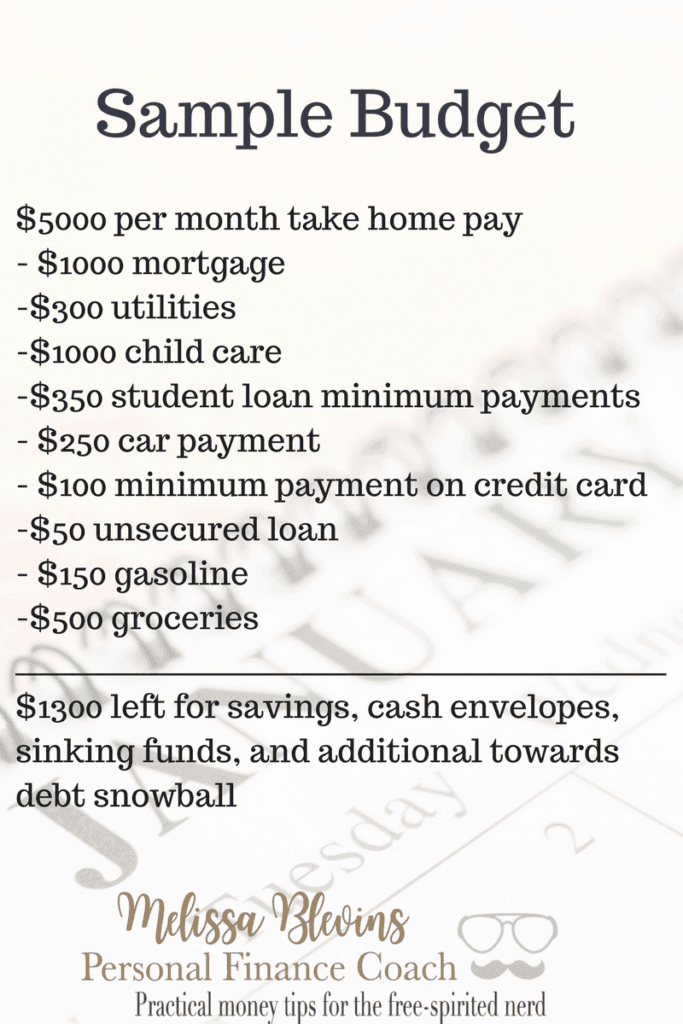

Here’s an example of what a budget should look like:

By putting pen to paper (or fingers to Xcel spreadsheet), you’re able to assess the situation so that you can move forward with a plan for the new year. Hopefully, it’s not as bad as you thought!

Step 2: List your Priorities

According to Dave Ramsey, your most powerful wealth-building tool is your income. If we all started out living on 60-70% of our income (while saving a huge chunk), we’d be in a much better place than we are now. It’s time to change that. Make a list of what you want to accomplish in 2018. Maybe you’d like to be able to pay your taxes without owing Uncle Sam. Perhaps you’d like to pay off a massive chunk of debt. You might even just want to make it through the year without your kids’ lunch accounts going into the red (and receiving a call from the school that they’re eating pb&j until you pay). Whatever your goals are, write them down so you can come up with a clear plan of action.

Step 3: Subscribe

I want to help you crush your goals in 2018, and with a background in financial services and a passion for teaching others how to manage their money, I am looking forward to making this our best.year.ever! By subscribing, you’ll get access to information on the best way to build or repair your credit, how to make a plan to save cash for your kids’ college, tips on buying your first home (including all of the loan types), and so much more! I’ll be posting videos and writing blog posts, so you can catch up on whichever platform is easiest for you!

By remembering that this is a New Year, but you are the same you, you’ll be able to recognize what has held you back in the past from achieving success in your financial life. Let’s make 2018 the year you pay off more debt, save more money, and move towards a brighter financial future.

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.