This post may contain affiliate links. Click here to read my full disclosure.

One of my favorite things to talk about is the “car poor” problem in America. This question comes from James Anthony regarding my YouTube video about How to Sell an Upside Down Car.

Today I’m going to share with you how buying a new minivan could cost you $2.6 million dollars (and your financial security at retirement).

James writes, “I have a 2107 Nissan Sentra. I owe about $20,000. But it’s only worth $10,000. What do you recommend? I had negative equity roll over to the Sentra. That’s why I’m $10,000 in the hole.

James’ problem is all too common. I’ll be the first to admit I used to have a car trading problem. I think I was addicted to the thrill of getting a new car every year or two. We literally bought and traded 15 cars in 10 years.

FIF-TEEN, y’all.

So what can you do if you’re car poor and owe more than your car is worth? I’ll answer James in a moment, but here’s a wake-up call.

Step 1 – It’s time for a ‘come to Jesus’ meeting.

How many cars have you owned in the past 10 years? Have you traded vehicles frequently? Maybe you haven’t messed up quite as bad as I have, but if you see a pattern of trading vehicles (and adding the negative equity to the new car loan), you, my friend, have a problem just like I did. It’s time to admit it.

Step 2 – How Can I Tell if I’m Car Poor?

As a rule of thumb, you should always put 20% down on a car purchase, never financing more than 48 months on the term. And never, ever carry a payment more than 10% of your net (take-home) pay every month.

So if you earn $4,166 per month (or $50k per year), your car payment should be no more than $416 per month with a 4-year term (after you’ve put 20% down).

The ideal situation is to pay cash for cars, but many of us are already in a pickle! That’s why you’re here reading this right now. I’m not here to judge you. I’m here to help you!

If the person in the scenario above earns $4166 per month, and her car payment is $416 per month for 60 months, she’s car poor.

If you earn $50k per year take-home income and want to buy a $30,000 car, let’s take a look to see if you can afford it.

Remember, this is based on $4166 per month take-home:

- 20% down on a $30,000 car = $6,000 – Do you have at least $6,000 to pay as a down payment?

- $24,000 financed at 4.5% apr for 48 months equals a payment of $547.

- This is more than 10% of your take-home salary every month, so you cannot afford this car.

How Much Car Can I Afford?

Remember, this is how to determine car affordability and how much car you can afford:

- Car Payment, Insurance, etc -10% of Take-Home Pay

- 48-Month Max Term

- 20% Down Minimum

Step 3 – How Much is Negative Equity Costing You?

Look at your financial situation ten years ago. How much car loan debt did you have at the time? What about five years ago?

Has the total amount of debt in cars increased over the past several years? If the answer is yes, that’s a big problem. The goal is to pay off your car loan debt so that you can start putting more money away for retirement and emergencies.

If your loan obligations from vehicles has increased, this is your wake-up call.

Step 4 – Make a Plan to Pay Off Your Car Debt

Now that you know what your patterns are for car debt, it’s time to make a plan to pay it off.

I usually say that credit cards need to be paid off before auto loans. However, there is no ‘one-size-fits-all’ financial plan. You can book a 1-on-1 call with me for 30 minutes-1 hour and I can help with your finances. Click the button to see my calendar and schedule an appointment!

Step 5 – Stop Justifying Trading in your Cars!

But Melissa…we’re having a third baby so we need a minivan. And the brand new ones come with warranties so we can just finance our negative equity into the new minivan and with rebates, it’ll offset the extra cost.

These are just excuses to justify your desire for a new car. Trust me. I came up with every excuse in the book! You’ll always be broke if you don’t open your eyes to these self-destructive financial patterns and stop NOW!

There are plenty of great used vehicles with third-row seating in the $10,000-$12,000 price range. Why finance $48,000 on a new minivan when you can buy a perfectly good used vehicle for much less?

What if you bought the used car and instead of having a $700 car payment, you had a $250 car payment and used the $450 to make extra payments? You could pay off this car in 14-17 months (versus $700 per month for 5 or 6 years).

Step 6 – Start Funding your Retirement Plan with your Car Payment Funds

It’s high time we get our retirement savings on track.

My favorite option is that you could pay $300 payments and start putting $400 into a pre-tax retirement account. Did you know that a single woman who earns $50,000 per year gross income and contributes $400 per month into a pre-tax retirement account saves nearly $600 in taxes per year?

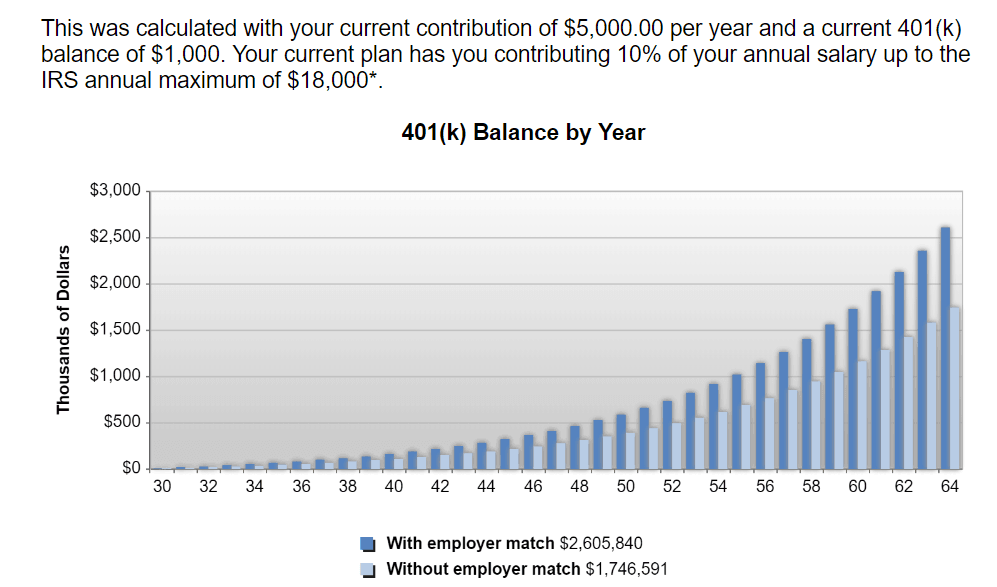

By contributing more than 10% of her income into a pre-tax retirement account, she’s setting herself up for financial freedom! Let’s assume that her employer will match 100% up to 5% of her contributions. This means that if she contributes 5%, her employer will match and contribute an additional 5%.

So she’s contributing $4800 per year, and her employer is contributing $2500 on her behalf. She now has $7,300 per year going into a retirement account (and is saving nearly $600 per year in income taxes).

Assuming she is a 30-year-old woman, she could have $2.6 million dollars in her retirement account by age 65 (assuming a 10% average rate of return and 2% annual increases at work).

This could be your future by deciding to stop the car-trading madness!

Step 7 – Debt Consultation Meeting

If you are thinking, “This all sounds great, but I am buried in debt and I have no idea where to start”, I get it. I’ve been there, too.

But you can’t ignore the problems. I’m offering debt consultation meetings five days per week to help you come up with a plan to take care of your debt.

Click the button below to view my calendar and schedule an appointment!

While it’s always best to pay off your debt, it can be very difficult to:

- Prioritize the order of debt repayments.

- Budget (especially if you aren’t great with numbers).

- Know where to start.

Back to James’ Ask me Anything Question:

“I’m $10,000 in the hole. What do you recommend?”

James, I recommend making the decision to keep your car and pay it off as soon as possible. As I stated above, my friend, you have an insane amount of negative equity and you’ll need a very large shovel.

Why would you want to trade in your car for less than it’s worth if it’s reliable and you can afford to make the payments? Why take the $10,000 loss?

It’s time to pick up some extra jobs or side hustles. Maybe consider starting a blog like this one to document your journey to paying off debt. You can also use your blog to make money. Here are all of my blogging income reports so you can see how much I’ve earned from the blog in 2019.

Use the extra income to pay extra towards your car loan, and you could easily take care of that $10k negative equity. But it’s going to take a very large shovel to dig out of this hole.

You can do it! I believe in you!

I’m so excited to be offering my financial coaching services to you! If you’re upside down in a car loan, know that you’re not alone. So many people fall victim to the trap that car dealerships offer. But is the cool, classy leather, the backup camera, and the heated steering wheel really worth 2.6 million dollars and sacrificing your financial legacy?! I think not!

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.

I found this article very interesting and helpful with a lot of insight that I haven’t especially come across before.

Thank for sharing with us