This post may contain affiliate links. Click here to read my full disclosure.

There is no denying just how expensive a child’s education can be these days. Sure, private tuition fees are extortionately high, and there is no sign of them being reduced any time soon. Even if you don’t send your kids to private schools, you will still find that putting your child through school can still be costly, even if you don’t need to pay for their tuition and course fees. After all, you will still need to pay for field trips, textbooks, and tech tools, such as laptops.

Worried about the burden that your child’s education will have on your finances? Well, you can’t exactly stop them from going to school, so it is just something that you need to be able to deal with. Here are some ways you can better equip your finances so that you can afford a great education for all your kids.

This post may contain affiliate links. See my full disclosure here.

Start Saving Early

The best thing you can do is to start saving as soon as possible. In fact, the majority of new parents now start to save money for their children’s education as soon as they are born. Even if you just put as little as $5 away into a savings account each week or month, you will find that this still starts to add up and will become a sizeable amount. Just make sure that these savings are going into a bank account that pays high interest, so that you will benefit from lots of interest added onto your cash.

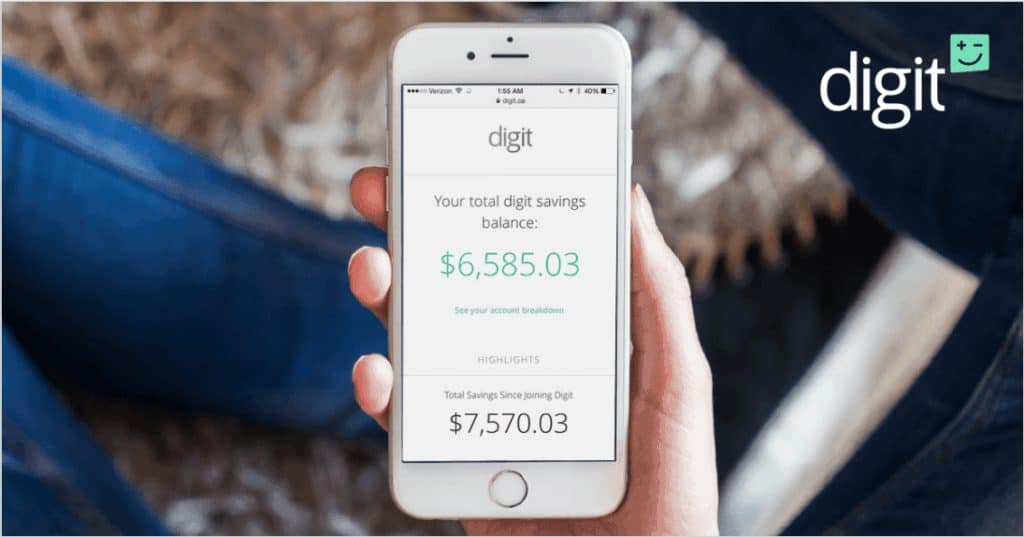

A great way to save money without having to think about it is with the digit app! Sign up here and start saving for your child’s future today! Every little bit adds up!

Look For Affordable Tech

These days, kids will use a lot of tech throughout their time in education. Even though the school should buy any specialist that children might need for their studies and school work, parents are often expected to foot the bill for a lot of tech as well. If you are struggling to pay for anything, you might want to use a payday loan consolidation service that can help you free up some cash. Not only that, though, but some schools will offer payment plans that can be a big help for families. Now, I am 100% anti-payday loans. As someone who got in a bind years ago and made the mistake of getting a payday loan, I can tell you that if you must use a consolidation loan to get out of the mess, do it. But vow to never go back to that place again!

Encourage Your Child’s Education

It’s always necessary to try and motivate and encourage your child to do well throughout their whole education. Firstly, this is good for them as it will help them achieve the grades they need to get their dream job. Not only that, though, but it could open up some scholarships to them. If they are able to get on a scholarship, then they will be able to go to a private school and have all their fees paid for them!

Review Your Overall Financial Position

It might be worth taking a look at your financial position as a whole. If you can pay off some debt and improve your credit rating, you may find that your budget improves. And that could leave you with a bit extra money to put towards your child’s education.

Hopefully, all of these tips will help you fund your child’s education so that they can achieve all of their goals at school!

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.