This post may contain affiliate links. Click here to read my full disclosure.

You may not think about your credit when you enter the hospital for an emergency or planned procedure. When you are in exceeding pain, the last thing that may cross your mind is how you are going to pay the thousands of dollars off when the exceedingly high medical bills come.

The problem is that the bills will come, and you will have to pay for them, and if you don’t, your account will go into a collection on your credit report.

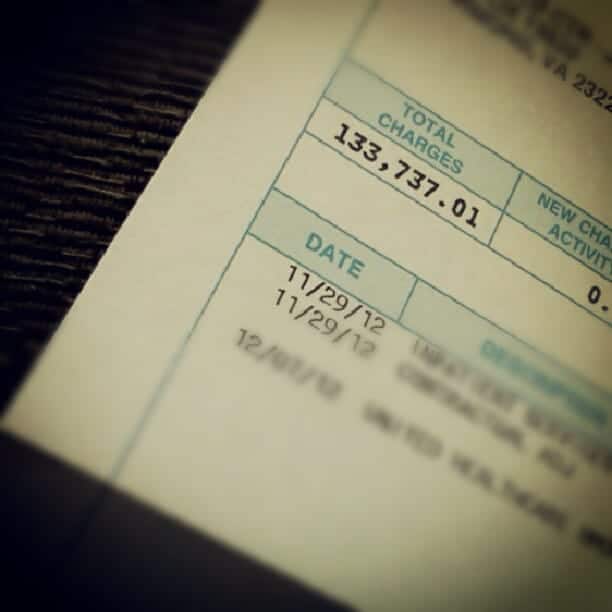

We certainly weren’t considering how medical debt affects credit until my son had an accident resulting in two surgeries to the tune of $60,000. Thankfully, we are members of Christian Healthcare Ministries and only had to pay $1300 out of pocket.

According to researchers, that is exactly what happened to more than one-half of the all the reported collection notices on credit reports across the United States.

To make matters even worse, more than 20 percent of everyone in the nationwide reporting system for credit has one or more medical collection accounts on his or her credit report. Here are a few thoughts on why medical debt makes the future bleak for the credit scores of Americans.

Insurance

While you may believe that those statistics belong to those individuals that are uninsured, you would be wrong. You may also believe that if you have a job, health insurance, and are under 50 years of age, you have nothing to fear.

Again, you would be wrong because one-third of all those medical collections reported cases are non-elderly consumers that have such high medical bills from so many different doctors and hospital specialists at the same time that the consumer finds it impossible to pay them all each month.

Top that with the fact more than 70 percent of the reported medical collections are against people that are insured, and you can see that there is quite a conundrum when it comes to medical debt and credit scores.

Scores

If you are still not concerned over the state of America’s credit health, you should also know that a single medical collection notice can drop a credit score more than 100 points.

To add insult to injury, when a credit score suddenly drops that many points, getting further credit or loans with decent interest rates is almost impossible, and the medical collection report stays on an individual’s credit report for seven years.

The individual often continues to fall behind in rising bills and then begins to sink in a cycle of loss and depression during those seven years.

Bills

Many people are unaware that their unpaid medical bills are reported to the credit bureau because they assume it is a separate category from their credit cards and car loans.

When you attempt to take out a loan after the company has reported medical bills, no matter how small the amount is, you may find yourself blindsided by the loss of so many credit score points.

Before confusion sets in, get in the habit of checking your credit score every month or two to ensure all is in order. If your bills were paid and still reported, talk to an attorney if the hospital or medical staff will not help you rectify the situation.

Untenable

Even if you work hard to cover all the bills provided each month, you may find your medical bills are untenable. Whether it is because so many bills come in all at once or the high amount of that each provider requests you pay, you may encounter bills you cannot afford to pay by the listed due date.

When that happens, contact the provider and see if they will work with you before they turn the amount due over to a credit collection agency.

Once that happens, the interest rates can often rise so fast that the amount will virtually never be paid off. An example would be for a $20,000 medical bill that has a 12 percent interest each year from a collection bureau.

The first month the interest would be $200, and if you didn’t pay that interest and an additional amount, you would end up spiraling down a long dark hole that could many times force you to seek bankruptcy.

In fact, the compounding high interest rates are so insane that if you didn’t make large payments, at the end of 30 years, you would owe the collection agency $718,992.00 on the original $20,000 bill.

Collections

The interesting thing about collection companies that most people don’t know is that debt buyers purchase bundles of debts from hospitals for about four cents per dollar owed.

In other words, your $20,000 medical bill would cost the collection agency around $800. Considering it would make that back in interest in four months, you can see why the agencies are so wild when it comes to contacting consumers that owe them money.

It makes one wonder why the hospitals and medical agencies don’t allow the consumers to buy their bills for the same amounts the debt buyers are offered.

You can see that the American system of medical debt and how it works with credit is broken, and the future is looking bleak because of it.

When you deal with medical debt, no matter how much that debt is, the bills are often on top of the other monthly costs you have for food, shelter, and transportation.

Since more than half of the American population is barely surviving between paychecks, you have to wonder exactly how they could manage even a minor medical bill. The answer is simple – most households can’t.

No wonder the medical industry finds themselves lowering so many credit scores. The system is broken and in need of fixing before it breaks America.

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.