This post may contain affiliate links. Click here to read my full disclosure.

Debt Snowball vs Debt Avalanche: What’s the difference, and which one works best? It’s no secret that your biggest wealth-building tool is your income.

Different personal finance gurus have varying opinions on whether the snowball method is better for paying off debt or if the avalanche will help you obtain financial freedom faster.

Dave Ramsey recommends the debt snowball vs debt avalanche, and Suze Orman prefers the debt avalanche.

I’m going to share the differences between the two and at the end of this post, you can grab a copy of a FREE Debt Snowball Spreadsheet.

Debt Snowball vs Debt Avalanche: What’s the Difference?

The debt snowball method involves listing your debts in order (from the smallest balance owed to the largest balance owed).

You then create a budget and start paying as much as you possibly can (with extra funds after all bills are paid) towards the smallest debt, while paying minimum payments on all other debts.

As you pay off each debt, you’re able to add that minimum payment to your debt snowball for the next creditor, attacking them one by one until you’re finally debt free!

Dave Ramsey loves the debt snowball vs debt avalanche because it helps you build momentum, giving you “quick wins” so you’re even more motivated to stay on track.

The debt snowball method is especially great if you have a free-spirited personality and tend to wander (and overspend) if you don’t see results right away.

Related post to debt snowball vs debt avalanche:

- Top Reasons the Debt Snowball is the Best Payoff Method for Quick Wins

- DTI Ratio for Conventional Loan {Calculating Debt to Income}

- Gazelle Intensity: The Unhealthy Path to Financial Freedom

The debt avalanche method of paying off debt is more about simple math than behavior. It involves listing your debts from highest interest rate to lowest interest rate and paying them off in that order, saving you money (sometimes thousands of dollars) in interest paid.

Nerds love the debt avalanche method since their logical, practical minds only see numbers and it just makes sense to focus on saving money rather than trying to get quick wins. Suze Orman is a huge fan of this method because she’s a geek (I mean…wait…what?)

Debt Snowball-Dave Ramsey’s Recommended Debt Payoff Plan

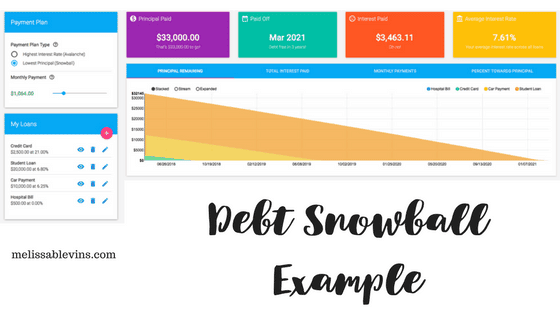

Let’s assume you owe the following debts (listed smallest balance to largest balance):

1. $500 hospital bill ($50 payment)

2. $2,500 credit card debt ($65 minimum payment)

3. $10,000 car loan ($265 payment)

4. $20,000 student loan ($185 payment)

Using the debt snowball method, you would make the minimum payments on everything except the hospital bill.

In this case study, let’s assume you have an extra $500 each month left over after paying all bills in your written budget.

Maybe you took out a second job or created a money-making blog. Maybe you’re delivering pizzas after work in the evenings. Perhaps you’re donating blood plasma for cash.

The point is you’re hustling to get this debt paid off.

So since you’re paying $550 a month on the hospital bill (the $50 payment plus the extra $500), that debt will be done in just one month.

You would then take that $550 and start killing the credit card debt. You can pay $615 towards the credit card balance per month ($550 plus the $65 minimum payment).

If you stick with it, you’ll have it paid off in just 4 months (sooner if you cut spending even more)!

Success!

Now you’ve got $880 per month to put towards your car payment. Do you see where I’m going with this? In just about 10 months, your car will be paid off!

Remember the day you bought it, beaming with pride, financing the negative equity from your trade and financed it way too long? Yeah, I’m onto you…I did the exact same thing!

In fact, we were upside down on my Honda minivan to the tune of $13,000 when we got out of it and bought a nice, used SUV with less than 100k miles.

Instead of owing $40,000 on a depreciating asset, we financed $13,000 on this gently used car. Our car debt was reduced by $27k!

Best.Decision.Ever! It doesn’t matter how fancy the warranty is on a brand new car. Even with the potential expense of a motor or transmission, the costs don’t rack up to how much you lose in purchasing a new vehicle.

Now it’s time to kick Sallie Mae to the curb! Your biggest (and for sure the most looming) debt is waiting for you to put $1065 a month toward it. In about 16 months, you’ll be 100% debt free!

It took you 31 months to pay it all off, but you did it! Of course, this is assuming you only have $500 per month to add to the snowball.

There will likely be bonuses, raises, and unexpected windfalls. There will also be emergencies, which is why I highly recommend starting an emergency fund savings with CIT Bank.

They pay a great interest rate, and your money is secure (FDIC insured) and far away from your checking account (to avoid temptation).

We opened a high-yield money market account with CIT Bank. They no longer call it a high-yield account but now offer a savings builder account, money market accounts, and no-penalty CD’s. You can open an account with as little as $100 and add a little each paycheck (with no obligation to save every single check).

Learn more about CIT Bank here.

Debt Avalanche – Suze Orman’s Favorite Debt Payoff Method

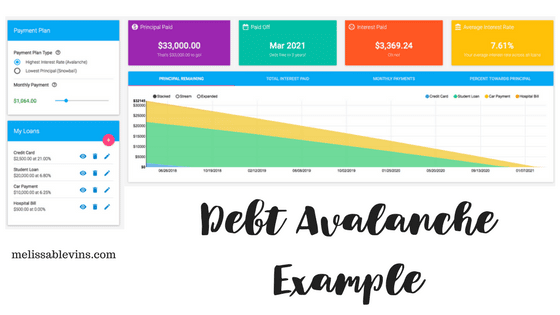

Now let’s look at the same scenario as above, but we’re going to list the debts in order of interest rates (highest to lowest). Obviously, the higher the interest rate, the more money you’ll pay, so the goal with the debt avalanche is to pay off the higher interest rate balances first.

Again, let’s assume you owe the following debts (listed highest interest rate to lowest rate):

1. $2,500 credit card debt ($65 minimum payment) 21% APR

2. $20,000 student loan ($185 payment) 6.8%

3. $10,000 car loan ($265 payment) 6.25% APR

4. $500 hospital bill ($50 payment) 0% APR

In this scenario, you’re able to pay an extra $500 per month towards your debt avalanche payoff plan. You’ll pay the minimum payments on all accounts, except for the one with the highest interest rate.

Add $500 to the minimum payment of $65 on the credit card account, and continue down the list as you would on the debt snowball above.

In the debt avalanche method, it will take you approximately 30 months, saving you one month in payments.

Many financial bloggers argue about the amount of interest paid.

Debt Snowball Interest vs Debt Avalanche Interest

Using the debt snowball method, you’ll pay $3,463.11 in interest and the debt will be paid off in 31 months.

Using the debt avalanche method, you’ll pay $3,369.24 in interest and the debt will be paid off in 30 months.

You save one month and $93.87 in interest paid by choosing to pay off debt using the debt avalanche method.

So Which is Better? Debt Snowball or Debt Avalanche?

I mentioned earlier that free spirits tend to sail wherever the wind takes them. They overspend, they hate planning, and they need the quick wins a debt snowball can provide.

Nerds are numbers people who love geeking out over the budget. They may have even planned out their debt payoff plan to pay off their home 20 years earlier than planned! The debt avalanche would be more appealing to most nerds.

If you’re a free-spirited nerd like me, a combination of the two personality types, you need to be completely self-aware of what motivates YOU.

I need quick wins to stay motivated. So the debt snowball is more appealing to me. However, there have been times that my nerdy side told me to pay off a balance with a higher interest rate first because it was driving me nuts to just pay the minimum every month on it.

You have to do what works for YOU! After many years of struggling with paying off debt, I finally found what works for me.

And I’m excited to share that with you! I’m working on creating a couple of courses that you can complete in the comfort of your home in your spare time! I’m really excited about it, and I can’t wait to share it with you!

In the meantime, grab your free Debt Snowball Spreadsheet so you can find out exactly how many months until you’re debt-free!

Life is a collection of memories and experiences. There are ups and downs. I am so grateful for God’s grace and am on the journey to a renewed spirit, free of perfectionism. Perfection Hangover offers the sober truth – no filter.

Pingback: Top Personal Finance Blogs {Who to Follow this Year}

Pingback: How to Be Frugal Without Sacrificing Quality of Life | Perfection Hangover

This is a great post and I totally agree- there’s more to both sides – there’s math that offsets the debt snowball but psychology that offsets the avalanche. I agree, it depends on the person and what motivates them to actually get out of debt more than it is about the method of getting out of debt.

Thanks, Dan! I think that finances are so much more of a mental and psychological game than just a numbers game.

Thanks for posting this one. Truly, very helpful and informative! Great article and video presentation.

Thanks for your comment! I’m glad you enjoyed it, Alan!

Think that’s the most thorough comparison of Snowball and Avalanche. I think Dave Ramsey could even learn something from it 😉 This post is going to be featured next Monday on the Robin / Dominguez Awards.

Good job!

That’s quite the compliment, Chris! Thank you so much! 🙂

This was really interesting to read. I don’t have much debt but I want to to be completely debt free and this helped me decide which way to do it. Thank you!

I’m so glad you found it helpful, Leigh-Ann!

I never thought of myself in the debt avalanche category! Lol. I love this. Definitely the nerdy type.

Yes! You never know what type you are until you really think about your behaviors! Glad you enjoyed it, Elaine!

There must be many like me who find finance intimidating and this really helps to grasp the idea! I am surely a free-spirited one as I prefer debt snowball.

Thank you, Kanishka! I’m glad this helped you identify which money personality type you have so you can move forward to setting the right goals! You can grab a copy of my free SMART goals worksheet here https://perfectionhangover.com/smart-goals

Thank you for this post and for explaining the difference between two in such simple words. You have actually in a way removed all my doubts.

Glad I could help! 🙂

hey.. loved the flow of the article, the way you started off by clearly defining the differences and then slowly coming down to which is better!!

Cheers!

https://www.placesinpixel.com

Thanks, Mainak! I appreciate that!

I like the debt avalanche method better, because it takes a bigger bite out of the debt, since it starts with the biggest debt, rather than the smallest. If you pay the greatest amount of debt first, it will take less time for you to pay it all off.

I’m willing to bet you’re the “nerd” out of the free spirit vs nerd personality types 😛 Nothing wrong with the debt avalanche! I’ve done a mixture of the two!